How Custom Private Equity Asset Managers can Save You Time, Stress, and Money.

Wiki Article

How Custom Private Equity Asset Managers can Save You Time, Stress, and Money.

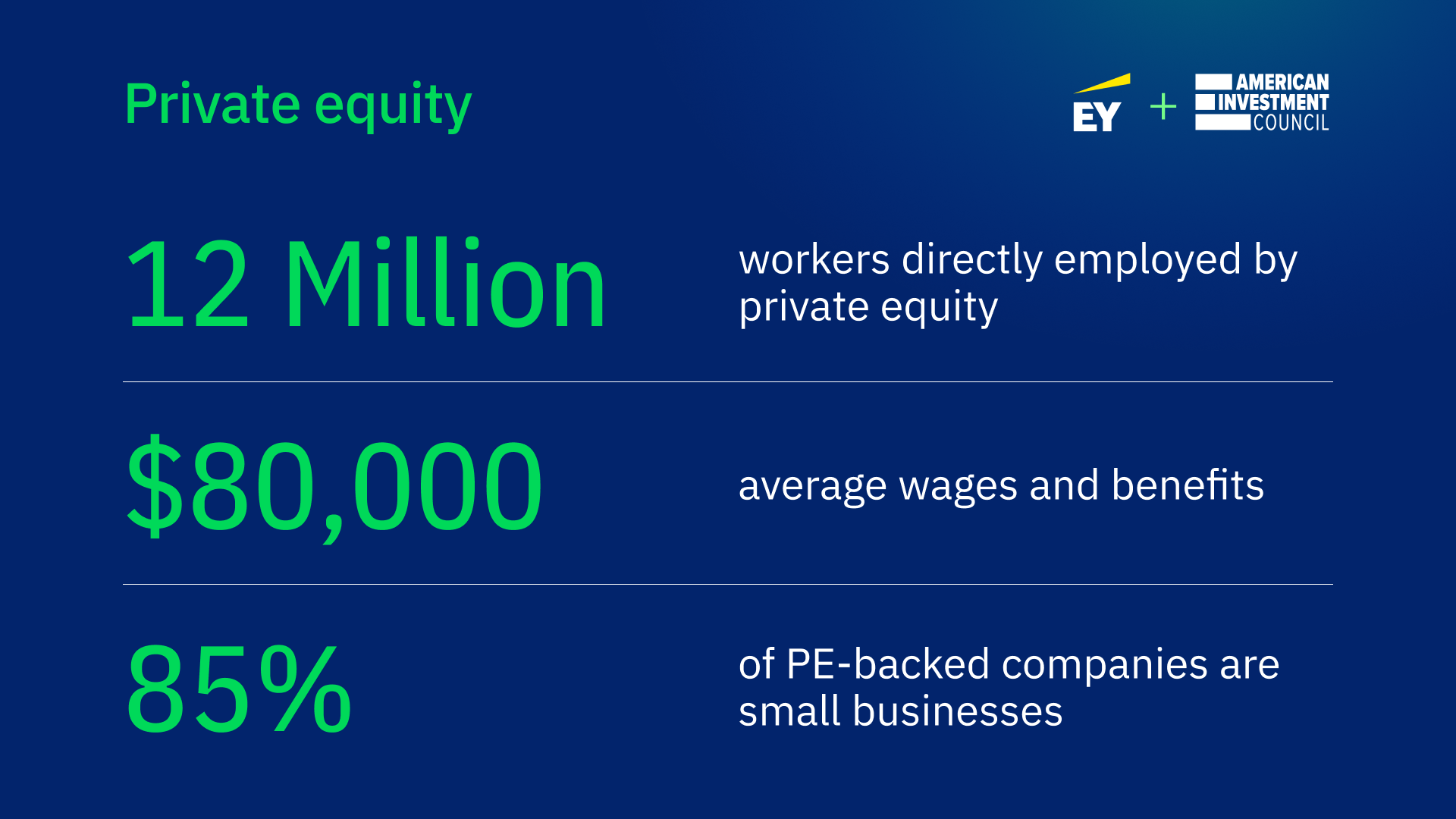

(PE): spending in companies that are not openly traded. Roughly $11 (https://slides.com/cpequityamtx). There may be a few things you do not comprehend concerning the industry.

Personal equity companies have a variety of investment choices.

Due to the fact that the finest gravitate towards the bigger bargains, the center market is a significantly underserved market. There are more vendors than there are highly seasoned and well-positioned finance experts with comprehensive purchaser networks and resources to manage a deal. The returns of personal equity are usually seen after a couple of years.

Things about Custom Private Equity Asset Managers

Traveling listed below the radar of big multinational corporations, most of these More Bonuses little companies usually provide higher-quality client solution and/or particular niche products and services that are not being used by the large conglomerates (https://custom-private-equity-asset-managers-44593031.hubspotpagebuilder.com/custom-private-equity-asset-managers/unlocking-wealth-navigating-private-investment-opportunities-with-custom-private-equity-asset-managers). Such advantages bring in the passion of personal equity firms, as they possess the understandings and wise to manipulate such possibilities and take the firm to the next level

Most supervisors at profile business are provided equity and bonus compensation structures that award them for hitting their monetary targets. Private equity possibilities are typically out of reach for people who can't spend millions of bucks, but they shouldn't be.

There are policies, such as limitations on the accumulation amount of cash and on the number of non-accredited financiers (Private Investment Opportunities).

Unknown Facts About Custom Private Equity Asset Managers

One more negative aspect is the absence of liquidity; when in a personal equity transaction, it is hard to leave or sell. There is a lack of flexibility. Private equity also comes with high charges. With funds under administration already in the trillions, exclusive equity firms have become eye-catching financial investment automobiles for wealthy individuals and organizations.

Now that accessibility to private equity is opening up to more individual financiers, the untapped capacity is ending up being a truth. We'll start with the primary disagreements for spending in private equity: Exactly how and why personal equity returns have actually historically been greater than other possessions on a number of levels, Just how consisting of exclusive equity in a profile affects the risk-return profile, by helping to diversify versus market and cyclical risk, After that, we will certainly lay out some essential factors to consider and dangers for private equity investors.

When it concerns introducing a brand-new possession right into a portfolio, one of the most standard factor to consider is the risk-return account of that property. Historically, exclusive equity has actually exhibited returns similar to that of Arising Market Equities and greater than all other standard asset courses. Its reasonably reduced volatility coupled with its high returns produces an engaging risk-return profile.

The 7-Minute Rule for Custom Private Equity Asset Managers

In fact, exclusive equity fund quartiles have the largest variety of returns throughout all alternate asset courses - as you can see below. Methodology: Interior rate of return (IRR) spreads calculated for funds within vintage years independently and after that averaged out. Average IRR was calculated bytaking the average of the mean IRR for funds within each vintage year.

The takeaway is that fund option is vital. At Moonfare, we perform a rigid choice and due diligence procedure for all funds provided on the system. The effect of including personal equity into a profile is - as always - depending on the profile itself. A Pantheon research from 2015 recommended that consisting of exclusive equity in a profile of pure public equity can open 3.

On the various other hand, the finest personal equity companies have accessibility to an even bigger swimming pool of unidentified opportunities that do not deal with the very same scrutiny, in addition to the sources to do due diligence on them and identify which are worth purchasing (TX Trusted Private Equity Company). Spending at the very beginning implies higher threat, but also for the companies that do prosper, the fund benefits from higher returns

The Ultimate Guide To Custom Private Equity Asset Managers

Both public and personal equity fund supervisors devote to investing a portion of the fund yet there remains a well-trodden concern with lining up passions for public equity fund management: the 'principal-agent issue'. When an investor (the 'primary') employs a public fund supervisor to take control of their capital (as an 'agent') they hand over control to the supervisor while preserving ownership of the possessions.

When it comes to exclusive equity, the General Companion does not simply gain a monitoring cost. They additionally earn a portion of the fund's profits in the form of "carry" (typically 20%). This makes sure that the rate of interests of the supervisor are lined up with those of the financiers. Personal equity funds additionally minimize another form of principal-agent trouble.

A public equity capitalist inevitably desires something - for the administration to enhance the supply rate and/or pay out dividends. The investor has little to no control over the choice. We showed over the number of personal equity methods - specifically majority buyouts - take control of the running of the business, guaranteeing that the long-term worth of the business comes first, pressing up the roi over the life of the fund.

Report this wiki page